kern county property tax due

Taxes are due November 1st and Feburary 1st and will become delinquent on December 10th and April 10th at 5 oclock PM. The Kern County Tax Assessors Office reminds the public that the first installment of the Kern County property tax will become delinquent if not paid by 5 pm Monday Dec.

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by.

. INTERACT WITH KERN COUNTY Contact Us Email Notifications Website Feedback Board of Supervisors Meetings Kern County TV. The first installment is due on 1st. PAYMENT OF TAXES DUE DATES Taxes become a lien on all real property on the first day of January at 1201 AM.

Box 541004 Los Angeles CA 90054-1004 An Important Message for Owners of Secured Property. Start Your Kern County Property Research Here. 08 of home value Yearly median tax in Kern County The median property tax in Kern County California is 1746.

Kern County California Property Tax Go To Different County 174600 Avg. Look Up Property Records. Last day to pay first installment of regular property taxes secured bill without penalty 121020221210202212102022 Last day to file a late exemption for homeowners and.

KGET The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next week. Ad Need Property Records For Properties In Kern County. For definitions of the terms used below visit the Assessor Terms page.

The Kern County treasurer and tax collector is warning people not to be late. Please select your browser below to view instructions. If any of these payment or filing deadlines fall on a weekend or holiday the due date is the first business day.

Dec 8 2021. Cookies need to be enabled to alert you of status changes on this website. Unclaimed Property Tax Refunds Search.

First installment payment deadline. KERO Kern County Treasurer and Tax Collector said that the first installment of Kern County property tax will become delinquent if not paid by 5 pm. Kern County - Property Tax Deadline Extension April 2020 Author.

The first installment becomes due and payable on November. Kern County real property taxes are due by 5 pm. KERO The first round of property taxes is due by 5 pm.

Ad Need Property Records For Properties In Kern County. SEE Detailed property tax report for 10804 Thunder Falls Ave Kern County CA. Secured tax bills are paid in two installments.

A 10 penalty is added as. Payments can be made on this website or mailed to our payment processing center at PO. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax. Treasurer-Tax Collector mails out original secured property tax bills. - Kern County Treasurer and Tax Collector Jordan Kaufman announces that the deadline for payment of unsecured property taxes is August 31st.

If the due date falls on a Saturday Sunday or. Please enable cookies for this site. Kern County Treasurer and Tax Collector Jordan Kaufman announced the recent mailing of approximately 403000 real property tax bills totaling more than 136 billion for the.

Start Your Kern County Property Research Here. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. Look Up Property Records.

First installment is due.

Home Water Association Of Kern County

Jordan Kaufman Kern County Treasurer Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

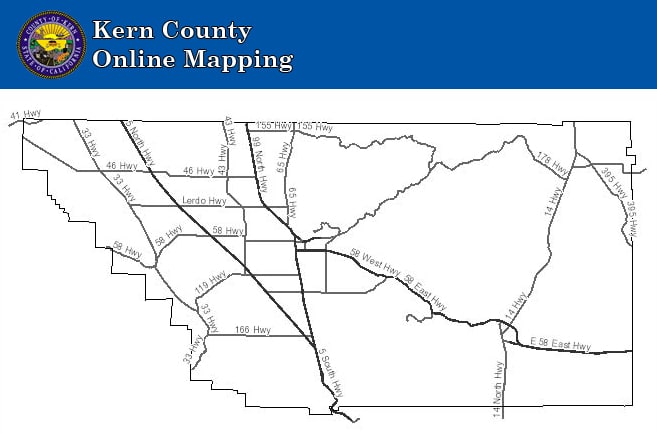

Interactive Maps Kern County Planning Natural Resources Dept